Why Solar Energy in Hungary?

-

30 August, 2022

- Posted by: Orly Vidal

Globally, the volume of annual solar irradiation that attains the earth surface is 2x 1024 J; from this amount, the proportion that arrives to continental lands is approximately 2000 times more than annual global energy consumption (Illes et al, 2019). This means that the potential of solar power on earth is abundant and exceeds humankind ´s existing need for energy thousands of times. Besides, for sustainable development goals and environmental protection, solar systems are prominent alternatives, as Sun is the source of most of the processes in nature (Pintér, 2020; Pintér et al, 2020) and is available for nearly every consumer (Zsiborács, 2014). Around the world, photovoltaic (PV) technology is the common option to use solar energy power, by converting the radiation of the Sun into direct energy. There are different types of PV technologies that are generally applied such as Amorphous Silicon, Monocrystalline and Polycrystalline (Table 1). From an efficiency perspective, the market share is led by crystalline technologies in 90% average.

Table 1. COMMON PV TECHNOLOGIES IN THE PV MARKET

| TECHNOLOGY | EFFICIENCY |

| Amorphous silicon (a-Si) | 10.50% |

| Monocrystalline (m-Si): | 22.30% |

| Polycrystalline (p-Si) | 26.70% |

In Hungary, the average solar daily Global Horizontal Irradiation (GHI) is 3.2-3.6 kWh/m2; the annual average is 1168-1314 kWh/m2 (Figure 1). In terms of solar Direct Normal Irradiation (DNI), daily levels are estimated in 2.8-3.4 kWh/m2; annually it totalizes 1022-1241 kWh/m2. According to the Hungarian Transmission System Operator by 2030 it is estimated an integration of 2500-6700 MWh/m2 from solar plants (Pintér, 2020). Owing to the advantageous position of the country in terms of solar radiation, sunshine duration and cost reductions, solar power is seen as the most important renewable energy source in the future (Deutsch and Berényi, 2020). This affirmation is based on the projections made for the National Energy Strategy and the National Energy Climate Plan (2020); indicating that the total installed capacity of solar plants will be in the range of 1663 – 4000 MW by 2025 and can achieve levels of 11975 MW by 2040. Using energy scenarios, the European Association for the Cooperation of Transmission System Operators (ENTSO-E) predicts the annual total share of PV- based power generation in 31.16% in a pessimistic, 37.17% in a real and 57.53% in an optimistic scenario (ENTSO-E, 2020).

Figure 1. DIRECT AND GLOBAL HORIZONTAL IRRADIATION IN HUNGARY

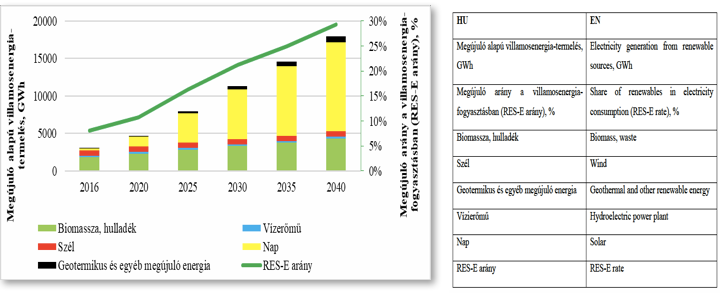

Since renewable energy is a very competitive market in Hungary, owing to its natural resource potentials (biomass, biofuel, solar, wind, geothermal), winners and losers are expected when new technologies and more efficient productive options emerge in the electricity sector. On this notion, according to the Ministry of Innovation and Technology, 58% of electricity from the Renewable Energy Sources (RES) will be generated by PV power plants in 2030, and 66% by 2040. The numbers show a notable increase considering the solar energy share reached in 2016, at levels of 7%. It represents an escalation of 729% in 14 years and 843% in 24 years respectively. Thus, while solar power will expand, in parallel the dominance of the biomass sector is expected to decrease from 60% in 2016 to 29% in 2030, representing a declined of 106% in 14 years for the electricity segment (Figure 2).

Figure 2. ELECTRICITY GENERATED FROM RENEWABLE SOURCES AND SHARE OF RENEWABLE ELECTRICITY IN CONSUMPTION

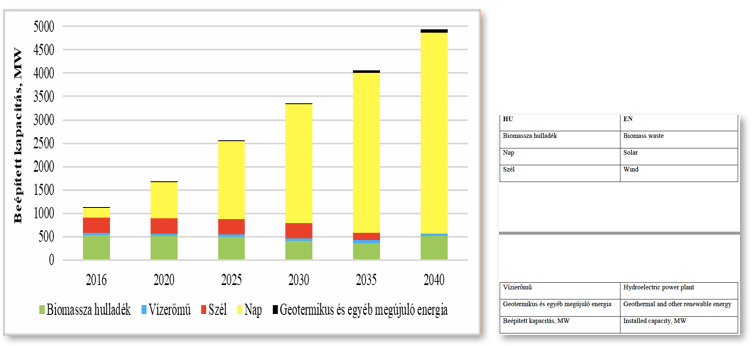

Forecasting the electricity sector where solar power has the major renewable share, the largest increase of PV production will conduct to an upsurge in the installed capacity from 3.5 GW in 2030 to 4.3 GW in 2040 (Figure 3). In retrospective, the total installed capacity of PV power plants from 2017 to 2019 had an important expansion of 238%, with 395.63 MW and 1340 MW levels respectively (MAVIR, 2020). These results are notably observed for the extensive investments at large scale performed in the solar energy sector, leaving behind small scale residential PV systems, whose dominance has been affected by two main factors: slow growth rate, usually because of pricing factors in a low and medium predominant society; and licensed PV power plants, whose capacity installations have chiefly dominated the electricity sector (Deutsch and Berényi, 2020). In fact, studies from the Hungarian Transmission System Operator have projected that in the near future no community-shared solar project is expected to be built or enter into operation, that means that most of the players can be medium to large companies (MAVIR, 2020).

Figure 3. INSTALLED CAPACITY WITH EXISTING MEASURES, MW

REGULATION, CHALLENGES AND OPPORTUNITIES FOR IMPLEMENTATION.

Hungarian ambitions expectations on the renewable sector have been the main reason of the exponential expansion of this market, specially among big players. Current Hungarian legislation supports these investments and different governmental institutions have backed them to boost potential economic sectors such as agriculture, manufacture and other industries. However, it is pertinent to remark that meeting energy demand has been a consistent issue in Hungary due to the country’s high reliance on oil and gas imports, especially from Russia. Moreover, due to the limited opportunities to substitute them with local production and the rise of pollution for using fossil fuels (Szlavik and Csete, 2012). During the last decades, Hungary has been heavily dependent on oil and gas at levels of 93% and 70% respectively. Oil is currently the main source of the transport industry and natural gas has the largest share of energy consumption in residential and commercial sectors. As a result, the primary objective of energy policies is increasing and diversifying the share of renewables sources and maintaining nuclear capacities to satisfy the whole energy demand (transport, heating, cooling, and electricity). High energy dependency is a potential threat to the country, being necessary to diversify and improve energy composition. In accordance with the European Union Directive (2009/28/EC) and the National Energy Climate Plan, Hungary must increase the share of renewable energy to 20% by 2030 in order to expand energy security but more importantly to be less reliant on international energy trade. Investments in renewables will also help to restore economic sectors particularly in rural areas, where innovation and technology can create added value to current and future developments.

At the present, the war between the two neighbour countries, Russia and Ukraine put at risk oil and gas imports and different political sectors from Hungary and the European Union have warned upon the hazard of relying so strongly on the international trading of essential products such as oil and gas. Irrespective of the political, economic, environmental or climate challenges, today Russia is almost isolated from the global market because of the financial sanctions imposed by most of the western nations but also due to Russian´s reprisals. The scenario has occupied the attention of Hungarians and the central government. On this fact, the last 26th of march the Prime Minister stated that Hungary is in disagree with the proposal of putting sanctions to the energy sector given that 85% of domestic households are heated by Russian gas and 64% of oil arrives from the same nation. Therefore, the country rejected the proposal and they will continue receiving oil and gas from Russia. On the 22th of March the Hungarian central government stated that “suspending energy imports from Russia would seriously jeopardise the security of oil and gas supplies and even double or triple the burden on Hungarian families”. Hungarians “condemn Russian military aggression and stand up for the territorial integrity of Ukraine, however, they insist that the costs of the war should not be paid for by Hungarian families”. With the last scenario, it is a clear the threat of being reliant on international energy trade. It will be an urgent strategy to rise renewable energy use, and solar energy will play a key role in future energy plans.

Support Schemes in the Solar Power Sector

METÁR is the supporting scheme of the renewable energy sector established by the Hungarian Energy and Utilities Regulatory Authority (MEKH). The scheme is oriented to support the energy production using renewable energy sources. The METÁR was created to improve new power plants investments through green premium grants awarded within the framework of a tender procedure (IEA 2021). According to the International Energy Agency (IEA), in April 2021 the MEKH announced the tender’s applications regarding three categories:

- For a capacity between 0.3 and 1 MW, allocation of up to HUF 200 million per year in subsidies for the production of 50 GWh of energy.

- For a larger capacity up to 20 GW, allocation of up to HUF 250 million per year in subsidies for the production of 250 GWh of energy.

- Support for a total of 300 GWh of electricity generation per year, contributing to the goal set in the Climate and Nature Protection Action Plan to increase the capacity of solar power plants six-fold in ten years.

Currently, solar PV systems can secure support through the METÁR by successfully bidding in the green premium auction system. The scheme has enhanced over time, providing a competition-oriented and market-based model where investors have a fixed feed-in tariff and stable cash flow, having to access the benefits even prior to the construction phase. On the other hand, consumers can reduce tariff prices owing to the subsidy system promoted by the scheme (MNB, 2020).

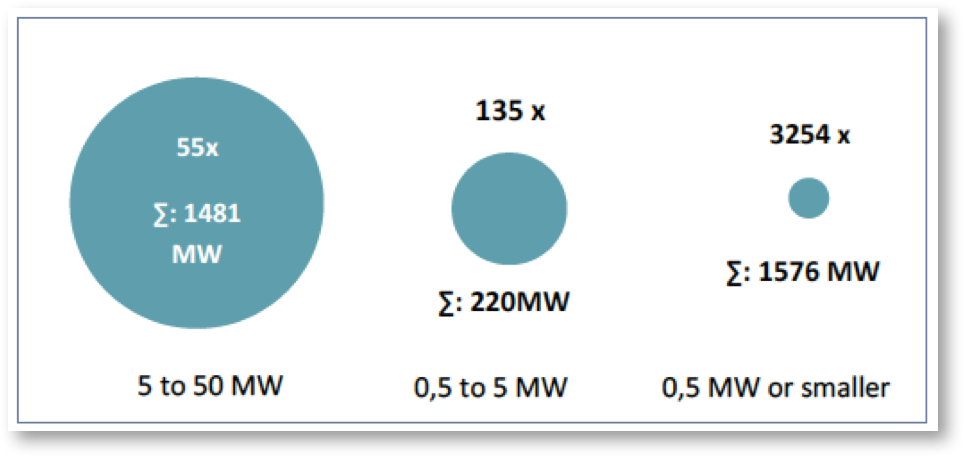

On the basis of total capacities, approximately 40% of solar projects are linked to the latter support schemes, at levels of 1300 MW. 95% of PV power plants have a capacity of 0.5 MW or less. These small-scale projects are dominant due to the regulatory system in the tariff scheme, resulting in simplified licensing processes. The largest projects reach 50 MW and the other part of the projects range between 0.5 and 5 MW (Figure 4). As there is a prevalence of projects built from clusters with several small PV plants, they are not stand-alone undertakings. However, the METÁR scheme and its large-scale project sizes will make this type of clusters less dominant (MNB, 2021).

Figure 4. SIZE DISTRIBUTION SOLAR POWER PLANTS (UNDER DEVELOPMENT AND COMPLETED)

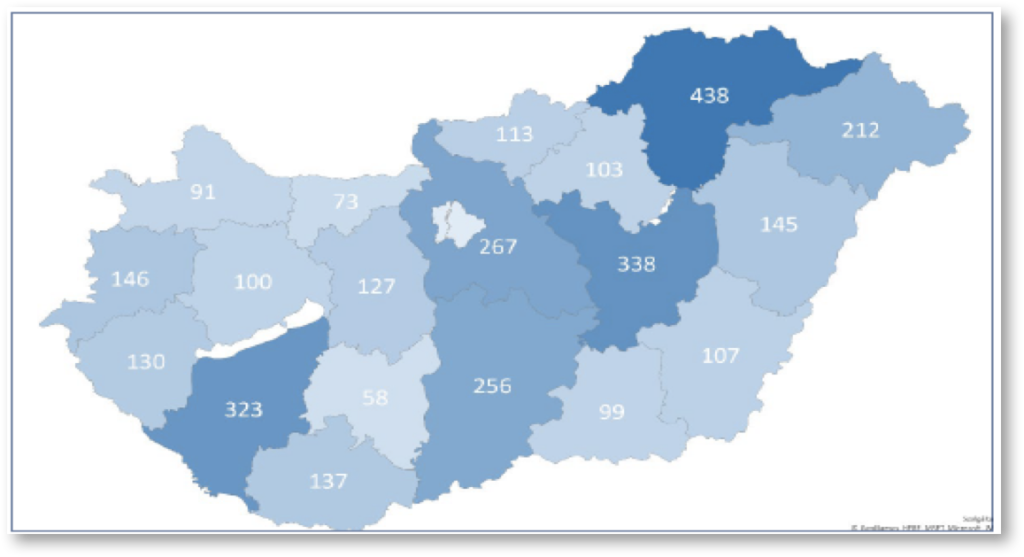

In terms of current regional distribution of solar PV power plants completed or under development, the largest are located in the following counties: Borsod-Abaúj-Zemplén with 438 MW; Jász-Nagykun-Szolnok with 338 MW; and Somogy with 323 MW (Figure 5). It is important to note that geographically, the most potential areas in Hungary for solar energy projects are Csongrád, Baranya, Tolna and Bács-Kiskun counties; however, there is a small amount of solar power plants among them. Contrariwise, the worst solar power potential is where further projects have been developed, that is the case of Borsod-Abaúj-Zemplén. As set above, the new METÁR scheme focused on large scale projects, will generate a new regional distribution scenario of solar plants in the future. Nevertheless, the Central Bank considers as a relevant feature how geographically decentralized is the nature of solar projects, which create more competitiveness. From a supply perspective, this factor may be beneficial for energy security and regional development policy.

Figure 5. GENERAL DISTRIBUTION OF PV POWER PLANTS (Solar MW Capacity)

Current Developers of Solar Power Plants Under the METÁR Scheme.

The Central Bank of Hungary states that the amount of power plants granted with the latter support schemes sum 1.795 developers. The majority are profit-oriented businesses. Some belong to municipal institutions or represent individual initiatives. At the sectorial scale, 60% belong to energy enterprises, 14% to the service industry and 9% to construction areas (Figure 6). In the case of energy enterprises, they are specifically oriented to the installation and operation of PV power plants. Most of them are recently founded, with limited assets, few employees and without revenues from other business activities.

Figure 6. DISTRIBUTION OF SOLAR POWER INVESTORS BY INDUSTRY

Contrariwise, 25% of developers possess more than 10 employees per project. Amid the largest, there are companies with more than 1000 employees. In aggregated terms, the solar energy sector contributes directly or indirectly to the availability of 21.000 jobs, not including the suppliers of materials and the employed during construction phases. An important aspect of the industry scenario is that the greatest amount of project companies belongs to interest groups or parent companies, which are also involved with similar projects. Estimations suggest that the 1.795 developers are organized into averagely 600-650 different stakeholders. Such interest groups can usually hold ten firms but exceptionally up to 100 firms. This data is based on the matching of project owners with similar company names but not on ownership data (MNB, 2020).

Financial Features of Present and Future Investments in the Solar Power Sector.

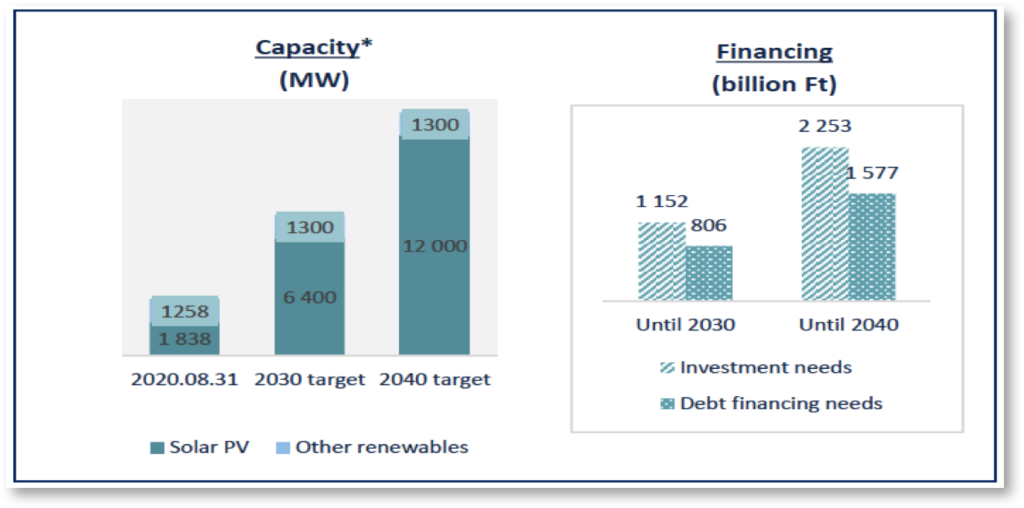

Based on the studies and analysis performed by the Central Bank of Hungary (MNB) and the Centre for Energy Policy Research, in order to increase the PV power capacities by 2040 at levels of 12000 MW, it is forecasted that HUF 2.250 billion (HUF 112 billion per year) of new investments will be necessary in the sector (Figure 7). Additional investments are required to cover the construction of energy storages and costs of grid development accounting HUF 500 million (MNB, 2020). Through these numbers, the country´s objective to decarbonize the economy and meeting the national energy demand can be achieved, following the European Union Directive (2009/28/EC) and the National Energy Climate Plan.

Figure 7. RESULTING INVESTMENTS AND FINANCIAL NEEDS

It is fundamental to reference that the Central Bank, as main financial and banking authority in Hungary, has different motivations performing the analysis which brings clues upon the potential of solar energy:

- To reduce the financial risks derived from climate change and other environmental future environmental challenges.

- Owing to the EU and Hungarian energy targets by 2030 and 2040 set in the National Energy Strategy, it will involve a variety of credit expansions and bank financing. Therefore, as guardian of the national financial stability, they are committed in pursuing the least possible micro-prudential risk.

- Regarding environmental regulations, the transition risk of climate change measures and sustainable development strategies from different industries, which will notably be transformed from a brown to a greener economy. For the energy sector, this conversion means a larger weight on green assets and support of green energy lending.

- The financial and banking authority estimates the potential opportunities that renewables will bring to the Hungarian economic growth. Furthermore, the macroeconomics benefits of the transition may provoke a gradual less dependence on international energy imports. With additional investments, the scenario can elicit new developments across different sectors with positive effects on sustainability approaches.

Considering the referenced motivations, it can be suggested that the Central Bank is projecting a future where renewables will transform and lead the energy share. The transition from a brown to a greener economy is nowadays the biggest ambition of decision makers and new actors are seeing this scenario as a potential market development. Likewise, the authority is applying precautionary principles to protect and create favourable conditions for the financing of renewable energy production, avoiding the risk of compromising further endeavours.

OPPORTUNITIES FOR FUTURE INVESTMENTS.

Considering the different opportunities that renewables can bring to the Hungarian economy and society, one of the main indicators of competitiveness and sustainable development is the capacity to think globally at the local level. As solar power represents an innovative and potential industry for the present and future energy demand in the country, its main attribute is the diversity of ways it can generate multiple opportunities of development and economies of scale. When doing investments, it is fundamental to identify those settlements and environments where things can be achieved, measured and exhibited. Because the Hungarian society has been historically exposed to multiple socio-economic pressures with effects in the Gross Domestic Product (GDP), unemployment, high exchange rates, low income levels, high interest rates and other macroeconomic variables, the main actors in the solar industries have been medium-size and large companies.

Accordingly, solar energy has brought new developments, and considering that in this generation the system is innovative per se, any settlement where it is implemented have created sustainable development opportunities mostly in social and economic forms. On this perspective, Deutsch and Berényi (2020) acknowledge that the viability and competitiveness of solar energy technologies are context-driven, and investors should not exclusively select and measure market competitiveness of solar solutions but also the current and potential business models to be open. The latter statement is key in the Hungarian case, as multiple solar projects involve governmental funding when they are intended to achieve further socio-economic benefits. On the other hand, when companies are the main investors, is through their sustainability and social responsibility strategies that other socio-economic benefits are met, measured and exhibited. The latter case is regularly noticed amid large companies.

Discussing with different Hungarian academics, despite they belong to different disciplines such as agriculture, economics and social fields; their conclusions were very similar, suggesting that those unique projects with impact into the society or the environment are broadly seen among large companies because of two reasons:

- Small and medium size solar companies have limited income surpluses or profits to make investments in any different field than the operation, installation or maintenance PV systems. if that is the case, they apply to EU funds or tenders, presenting specific objectives and destinations of those investments, which must have a socio-economic focus. They can receive support from municipalities or district authorities. As Hungary is considered an emerging economy, these types of companies are competitive if they play with their equals or if they receive additional public funds for specific purposes as mentioned before. Another aspect to consider is related to the materials to build PV systems, which are totally imported and exchange rates make the trading expensive. This feature is also perceived in operational and maintenance services.

- Large companies have the leverage capacity to deal with trading issues, exchange rates and market competitors. Because their business models usually incorporate other production areas, services or products, such investment portfolio brings financial support to the whole company. As a result, surpluses can be obtained and therefore new investment opportunities. It may involve sustainability programs or corporate social responsibility strategies oriented to community-based developments. Concerning the National Energy Climate Plan intended to achieve the future national energy demand and the European Union targets by 2030, large scale investment companies would be the main actors in the solar power market.

Regarding the renewable energy investments observed in rural communities, most of the benefits can be perceived in the following areas:

- Energy cost savings among local institutions such as hospitals, governmental organizations, schools, cultural places, among others. In general, operational costs have been reduced and therefore savings have helped to meet other relevant needs.

- Energy security, owing to the stability of the service mainly across deprived rural areas.

- Improvements on air quality with positive effects on human health.

- Gradual but slow new businesses growth.

Other indirect benefits:

- Renewable energy investments have brought new infrastructures to rural settlements such as roads and transport systems.

- Maintenance of machines and tools, predominantly in agricultural areas.

- Channels of communication regarding renewables such as training and community awareness sessions.

CONCLUSIONS.

The present document explored the potential role of solar power in the Hungarian market. The main criteria to select this renewable source is the National Energy Strategy and its commitment to reach lower carbon emissions. Additionally, the advantageous position of the country in terms of solar radiation and sunshine duration. Most of the developers in the solar power industries are large companies, with outstanding representation in the market. Some of them have performed remarkable social and environmental projects as part of their commitments in contributing to a sustainable future.

Since there are ongoing projects, investments can be performed in the future. However, it is critical to identify those settlements and environments where things can be achieved, measured and exhibited. Solar energy has brought new developments, therefore, any settlement where it is implemented have created sustainable development opportunities mostly in social and economic forms. The viability and competitiveness of solar energy technologies are context-driven, and investors should not exclusively select and measure market competitiveness of solar solutions but also the current and potential business models to be open. The latter statement is key in the Hungarian case, as multiple solar projects involve governmental funding when they are intended to achieve further socio-economic benefits.

REFERENCE LIST

Deutsch, N., & Berényi, L. (2020). Economic potentials of community-shared solar plants from the utility-side of the meter–A Hungarian case. The Electricity journal, 33(8), 106826.

Illes, Z., Szendro, P., & Unk, J. (2019). Considerations of Regional Coherences for the Development of Renewable Energy Technologies Used in South Part of Transdanubian Region of Hungary. Progress in Agricultural Engineering Sciences, 15(1), 71-98.

Pintér, G. (2020). The Potential Role of Power-to-Gas Technology Connected to Photovoltaic Power Plants in the Visegrad Countries—A Case Study. Energies, 13(23), 6408.

Pintér, G., Zsiborács, H., Hegedűsné Baranyai, N., Vincze, A., & Birkner, Z. (2020). The economic and geographical aspects of the status of small-scale photovoltaic systems in hungary—A case study. Energies, 13(13), 3489.

Szlavik, J., & Csete, M. (2012). Climate and energy policy in Hungary. Energies, 5(2), 494-517.

Zsiborács, H., Pintér, G., & Pályi, B. (2014). The energetic utilization of solar photovoltaic systems for individuals, price changes in Hungary. Review on Agriculture and Rural Development, 3(2), 459-466.

MAVIR, 2020. A magyar VER fogyaszt.i .s forr.soldali j.vők.pe, 2040. Input adatok. (Accessed 16 April 2020). https://www.mavir.hu/documents/.

ENTSO-E, 2018. TNDP dataset. . (Accessed 6 February 2019). https://tyndp.entsoe.eu/maps-data/.

National Energy Strategy 2030 (2020). Ministry of National Development. https://2010-2014.kormany.hu/download/7/d7/70000/Hungarian%20Energy%20Strategy%202030.pdf

Hungarian Energy and Climate Strategy (2020). Ministry for Innovation and Technology. https://rekk.hu/downloads/events/Energy__Climate_Strategy_Summary_EN.pdf

IEA (2022). International Energy Agency. Hungary. https://www.iea.org/policies/13946-renewable-energy-support-scheme-metar-2021

Central Bank of Hungary (2020). https://mnb.hu/letoltes/20210121-financing-the-hungarian-renewable-energy-sector.pdf

NECP (2020). National Energy and Climate Plan. Ministry of Innovation and Technology. https://ec.europa.eu/energy/sites/ener/files/documents/hu_final_necp_main_en.pdf

IEA (2022). International Energy Agency. Hungary. https://www.iea.org/countries/hungary

Hungarian Energy and Climate Strategy (2020). Ministry for Innovation and Technology. https://rekk.hu/downloads/events/Energy__Climate_Strategy_Summary_EN.pdf

Renewable Energy Directive (2009). https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-directive_en